“Why So Many Georgia Homes Are Falling Out of Contract in Fall 2025 — And How to Prevent It”

Why So Many Georgia Homes Are Coming Out of Contract in Fall 2025

The autumn of 2025 is seeing a surge in residential real estate contracts in Georgia that are collapsing—meaning homes go “under contract” and then revert to the market. For many sellers, that’s frustrating and expensive. Understanding why contracts fall through and how to proactively prepare your home for listing can make the difference between a smooth sale and a deal that falls apart.

Here’s what’s going on — and how sellers can stack the deck in their favor.

The Big Picture: Market Conditions & Buyer Behavior

Several macro trends are putting pressure on Georgia home sales in late 2025:

- Rising cancellation rates nationwide

Redfin recently reported that approximately 15.1 % of U.S. home-purchase agreements were canceled in August—an all-time high in their tracking.

And in the metro Atlanta region, up to 21 % of homes under contract were canceled in August—among the highest rates in U.S. metros.

This tells us that buyer hesitation is increasing. - Higher mortgage rates, tighter lending, and affordability strain

Buyers today are more financially constrained. Even if they’ve been preapproved, rising interest rates or stricter lending rules can scuttle closings.

For many buyers, there’s little room for surprise costs or big repair requests after inspection. - More available inventory gives buyers leverage

As more homes come on the market (or fall back on the market), buyers have more options. If one house shows problems during inspection or appraisal, they can more easily pivot to another home.

Sellers can no longer rely on scarcity alone to carry a sale through. - Inspection surprises and repair demands

Agents increasingly cite the home inspection phase as the number one reason deals collapse.

With buyer budgets tight, unexpected issues become deal breakers rather than opportunities to renegotiate. - Cold feet, buyer remorse, and emotional pull-outs

Some deals collapse simply because the buyer changes their mind, even when contingencies haven’t triggered.

In an environment of uncertainty, various shocks (loss of job, fear of overpaying, other listings) can push a buyer to back out.

Bottom line: The window for error is shrinking. Sellers can no longer expect that once “under contract” equals “sold.” It’s critical to preempt objections before buyers get to the contract stage.

Why “Prep Before You List” Is More Important Than Ever

If buyers are looking for reasons to walk away mid-contract, your job as the seller is to anticipate and eliminate as many of those reasons as possible before they ever see them. (Link to setup appointment for quotes: https://kellifinney.com/ )

Here’s why:

- Prevents shock discoveries during buyer inspections

- Reduces renegotiation leverage for buyers

- Improves buyer confidence and reduces their anxiety

- Strengthens your position in negotiations

- Helps ensure the contract survives to closing

- Do a Pre-Listing Inspection (Before Buyers Do)

Hiring a licensed home inspector before putting your home on the market gives you the chance to:

- Identify major issues (roof, structure, HVAC, plumbing, electrical)

- Get estimates or complete repairs on critical items

- Disclose known problems proactively to buyers

- Reduce surprises and “deal killers” once the buyer’s inspector comes through By addressing issues early, you cut off many buyer objections at their source.

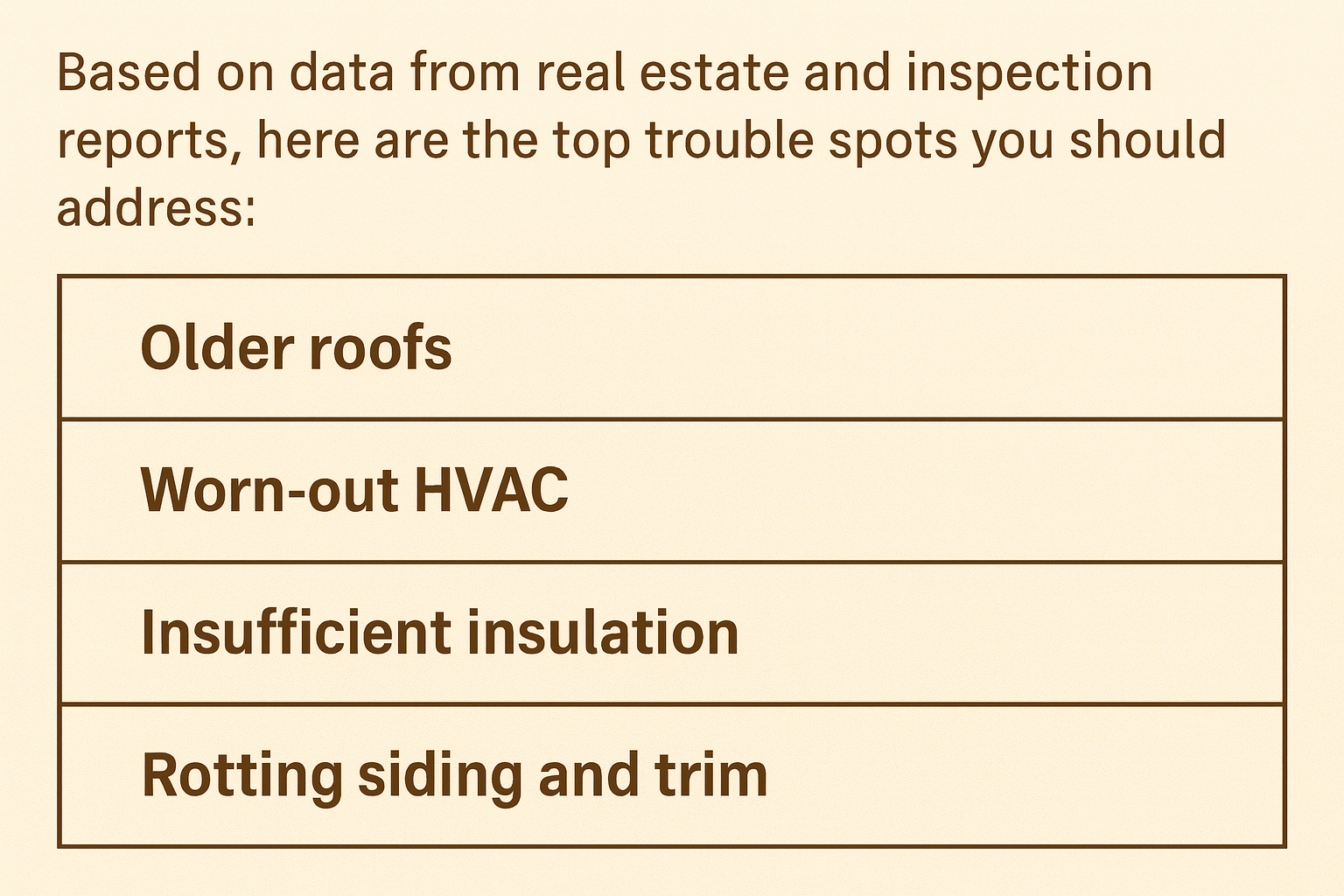

- Fix or Mitigate Key Issues That Commonly Kill Deals

Even if you can’t make every repair, having proactive, documented disclosures helps control the narrative.

- Clear Title, Permits & Documentation

One of the things buyers and their lenders dig into is the title and legal side:

- Check for any liens, judgments, or unresolved debts against the property

- Ensure your deed is clean and properly recorded

- Confirm any renovations were permitted and pass inspection

- Gather all warranties, maintenance records, invoices, disclosures

If title or document problems surface later, they may kill the closing. Sort them out in advance.

- Price Realistically & Strategically

Overpricing is a trap. If buyers see your home as “overpriced,” they’ll be more critical and reluctant to make concessions. In a market where they have options, they’ll simply move on.

- Do a comparative market analysis (CMA) with recent closed homes

- Factor in repairs you’ve done / will need

- Be willing to offer small credits or incentives rather than opening big renegotiations

A realistic initial price helps reduce buyer regret or second-guessing mid-contract. Get a CMA from an expert Realtor like Kelli Finney. https://kellifinney.com/

- Stage, Clean & Declutter (First Impressions Matter)

Even seemingly trivial things can tip a buyer’s mindset. A home that shows well signals “care and pride,” which builds trust.

- Deep clean (including windows, carpets, baseboards)

- De-clutter spaces; remove personal items

- Neutralize décor and paint in safe, broad appeal colors

- Ensure landscaping and curb appeal are strong

A polished showing environment helps buyers relax and imagine themselves living there — less emotional tension to “find faults.”

- Be Responsive, Transparent & Communicative

Once your home is under contract, how you respond matters:

- Answer buyer/inspector requests promptly

- Be transparent about known issues

- Update the buyer about progress on repairs

- Maintain open lines of communication through your agent

When buyers feel they’re being kept in the loop, they’re less likely to panic, doubt, or pull out.

- Add Contract Safeguards & Seller Protections

In your purchase agreement (working with your agent), consider:

- Strong earnest money deposits

- Clear repair negotiation timelines

- “Kick-out” or escape clauses (if buyer contingencies drag)

- Shorter inspection periods, with defined terms

- Limited seller obligations on “cosmetic” repairs

Well-crafted contract terms reduce loopholes buyers can exploit.

- Market Smart Timing & Seasonality

Fall is historically a slower season in many real estate markets. In Georgia:

- Buyers may be less active due to school schedules, holidays, or weather transitions

- Homes that linger attract more detailed scrutiny

- Competition from year-end listings (e.g. new inventory) intensifies

So you must launch your listing fully baked (i.e. fully prepped), because buyers are less tolerant of deficiencies during slower periods.

Hire a local real estate expert! Click the link https://kellifinney.com/

Categories

- All Blogs (43)

- aging in place (1)

- Ball Ground Georgia (2)

- buying a home (5)

- Canton and Cherokee County repeated throughout, with specific figures and trends. (1)

- Canton Georgia (4)

- caring for aging parents at home (1)

- Cherokee County GA home affordability (1)

- Cherokee County Schools (2)

- combining households with seniors (1)

- for sale by owner in Georgia (1)

- fun in Canton Georgia (1)

- Georgia homes contracts fall out (1)

- Georgia real estate fall 2025 trends (1)

- getting approved for a mortgage (2)

- hidden cost (1)

- home affordability (1)

- home affordability north metro Atlanta (1)

- home condition (2)

- home inspections (3)

- home purchasing tips (1)

- home repairs (1)

- home systems (2)

- homes under contract fall through Georgia (1)

- moving to Ball Ground Georgia (4)

- multigenerational home (1)

- multigenerational living (1)

- open house tips (1)

- Preparing you home for sale, Staging a home, Listing your home tips (1)

- purchasing a home (1)

- real estate professional (5)

- Reduce fall risk (1)

- safest places to live in Georgia (1)

- senior home safety tips (1)

- senior housing options North Metro Atlanta (1)

- seniors (2)

- seniors real estate specialist (1)

- What to look for when buying a home Home must-haves vs. nice-to-haves (1)

- why home sales fail in Georgia (1)

Recent Posts